Many older Americans experience some form of mental health concerns, with anxiety and depression being the most common. For family caregivers, helping seniors with mental health matters may be overwhelming. Depression and other mental health issues can greatly affect an older person’s quality of life. A person’s sense of purpose may diminish if they no longer have friends in their neighborhood or cannot drive to and from social activities. Isolation often leads to loneliness and depression.

In this blog post, we will explore how senior living communities can give back a sense of purpose and belonging, potentially prevent or improve mental and emotional health issues and give residents that social connection they need to thrive. In addition, we will explore the benefits of being proactive in finding a senior community earlier in your retirement.

The Social Connection

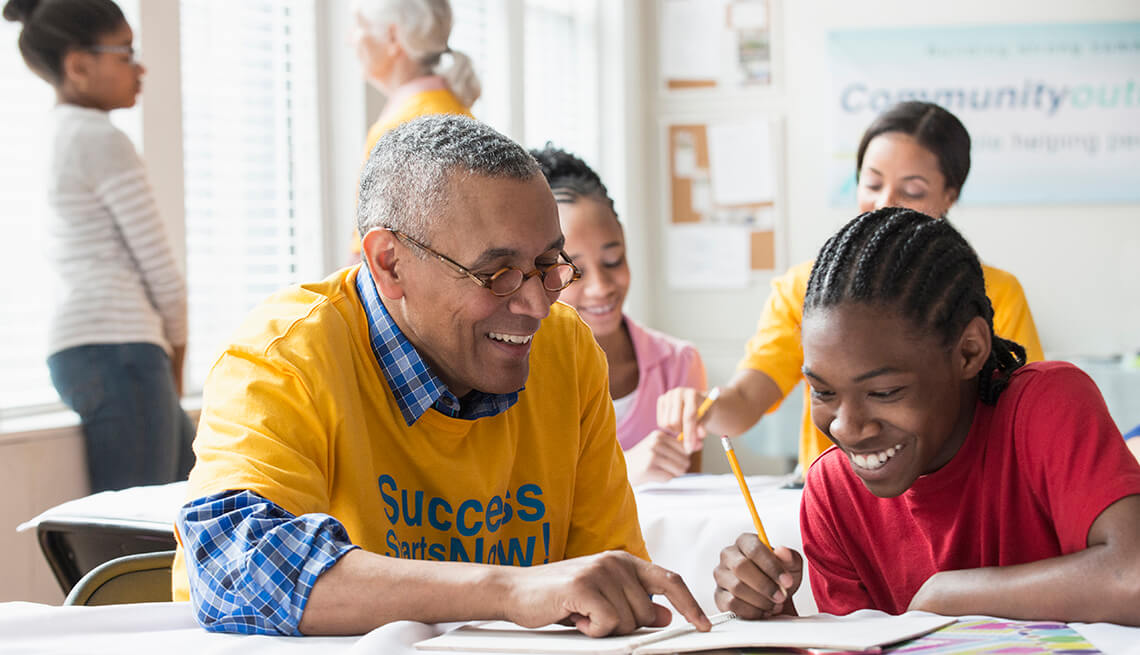

This rings true for all ages, but especially for older adults, that greater social connections will positively affect the quality of life, including physical, emotional, and mental wellbeing. Fortunately, in senior living communities, accessing these benefits is about as easy as taking a step outside.

In senior living communities, residents have many opportunities to build new friendships and join existing support groups. Whether during happy hours, meeting a new friend for breakfast, joining a group fitness class, or engaging in a group activity, older adults will find themselves surrounded by like-minded people, promoting a sense of belonging. Meaningful connections can serve as a source of laughter, joy, and even emotional comfort. All of these can reduce the feelings of isolation and loneliness that can often lead to depression and anxiety.

To learn more about Assisted Living options for seniors with mental health issues, CLICK HERE.